The Bank of America survey of global fund managers found that growth optimism trumps rate hike fears.

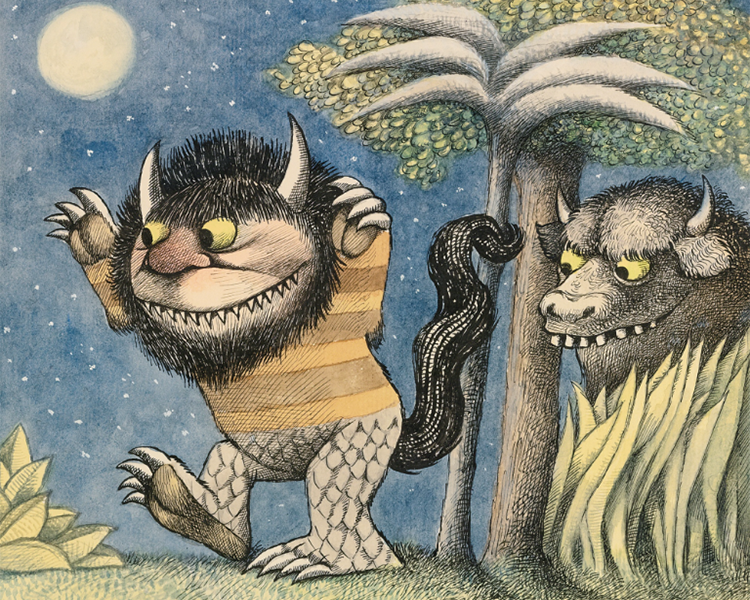

Let the rumpus begin full#

For those who want the full flavour of Grantham’s brilliant thesis, the original is here.įor the present, though, the comforting consensus is growth will take care of the problems. This is why at the end of the great bubbles it seems as if the confidence termites attack the most speculative and vulnerable first and work their way up, sometimes quite slowly, to the blue chips.” Note that in the US, while the speculative stocks have nosedived, the US Russell 2000 stock index has wiped out all 2021 gains and is back in 2020 territory. A plausible reason for this effect would be that experienced professionals who know that the market is dangerously overpriced yet feel for commercial reasons they must keep dancing prefer at least to dance off the cliff with safer stocks. This occurred in 1929, in 2000, and it is occurring now. Grantham warns, “The final feature of the great superbubbles has been a sustained narrowing of the market and unique underperformance of speculative stocks, many of which fall as the blue chip market rises.

Let the rumpus begin series#

0 kommentar(er)

0 kommentar(er)